PEP & Sanction – regulation technology by SEPA Cyber Tech Group

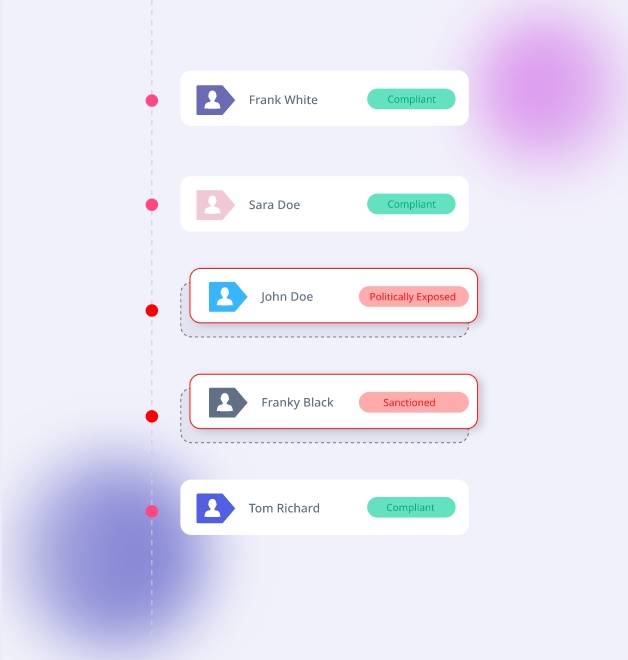

A crucial part of the KYC requirements is the screening for Politically Exposed Persons (PEPs) and sanctions. Organisations must perform a complete PEP and Sanction check when onboarding new clients and during ongoing customer reviews.

SEPA Cyber’s PEP and Sanction solution improves compliance efficiency by automation and aids in meeting all AML requirements.

With SEPA Cyber’s PEP & Sanction module you get

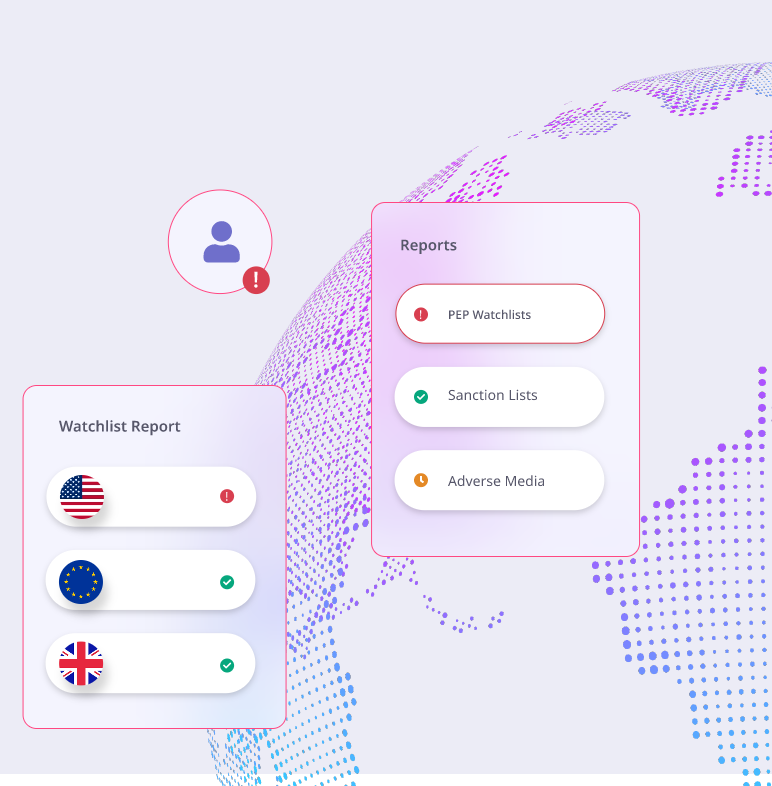

- Global sanction & watchlist (OFAC, HTM, EU, UN, etc.)

- Domestic and international politically exposed person lists

- Senior political figures lists

Your best solution if you need

Scalability

Adding extra functionalities with a single click

Automation

No more manual checking with our automation solution

Full Complience

Achieve full compliance and AML requirements

More than powerful regulation

- High degree of automation

- Uptime 99.99% of the time

- White-label solution

Step by step to

complete solution

Fill out our form, and one of our experts will contact you

You will get a demo of our branded core banking system.

Modularity means customer offer for each client

SEPA Cyber Tech is happy to be part of your payment journey

Go digital and optimise your onboarding and ongoing customer evaluation with SEPA Cyber’s PEP & Sanction solution.