Embedded Lending Platform by SEPA Cyber

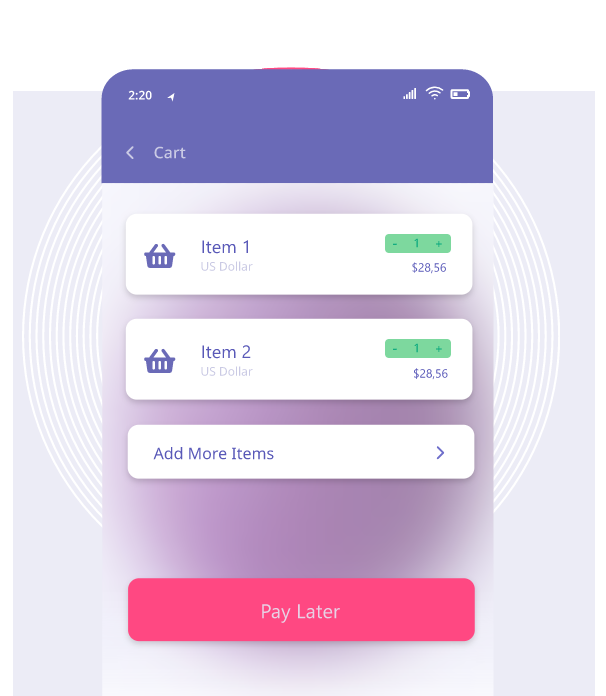

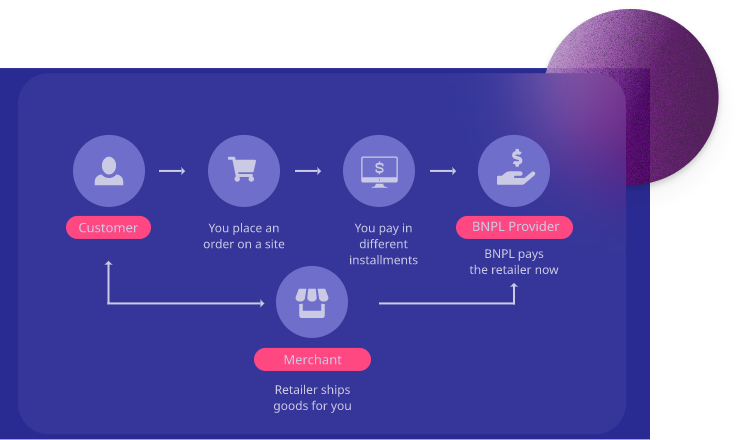

SEPA Cyber Tech Group’s white-label platform seamlessly embeds Buy Now Pay Later (BNPL) financing solutions into existing frameworks.

We have the perfect turnkey product if you’re an Electronic Money Institution (EMI), bank, or financial regulated company that wants to scale and diversify its business. Our BNPL solution is developed for companies of all sizes.

With SEPA Cyber’s embedded lending platform you get

- Debit, credit, or factoring-based financing schemes

- B2B and B2C compliance

- Complete white-label branding

- Core banking functions

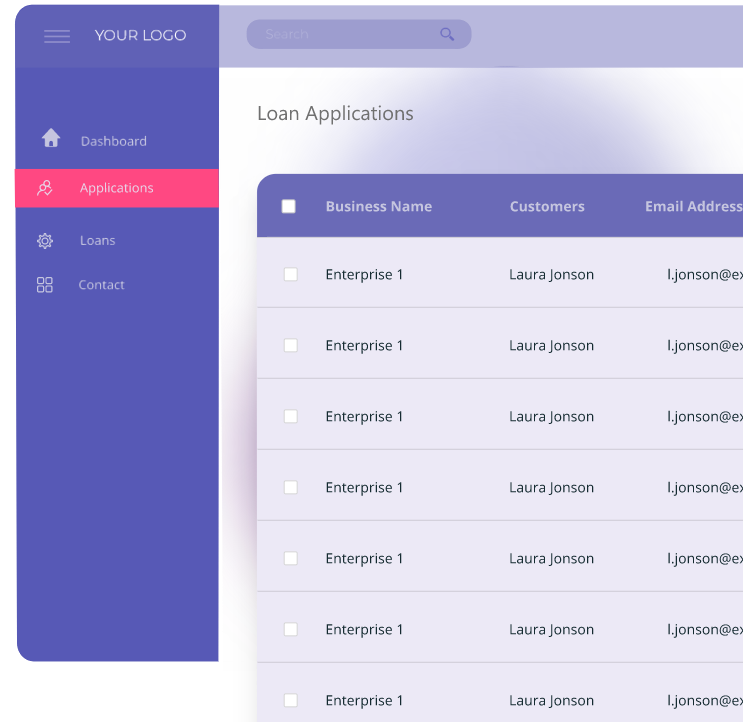

- Account management modules

- Automated onboarding (KYC, KYB, PEPs and Sanctions)

Your best solution if you need

BNPL Solution

Lend funds to individuals and businesses to empower them

Dependable RegTech

Comply with AML requirements by connecting our platform to our RegTech solutions

Core Banking

Offer core banking as part of your embedded lending financial service package

Direct Reporting & Reconciliation

Generate and send reports to government agencies, financial and non-financial institutions

More than an embedded lending platform

- Comprehensive BNPL product

- Worldwide availability

- Trustful partner

- PCI DSS Level 1 certified

Step by step to

complete solution

Fill out our form, and one of our experts will contact you

You will get a catalogue with all our devices and their services.

Modularity means customer offer for each client

SEPA Cyber Tech is happy to be part of your payment journey

Book your FREE meeting if you want a dependable platform for your embedded lending services providers