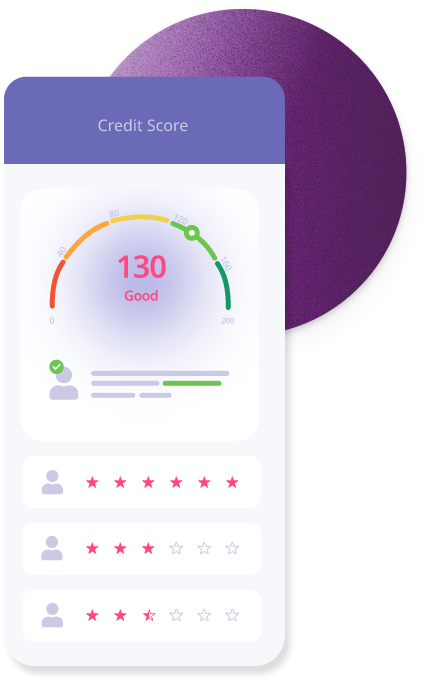

Ultimate credit scoring solution by SEPA Cyber Tech Group

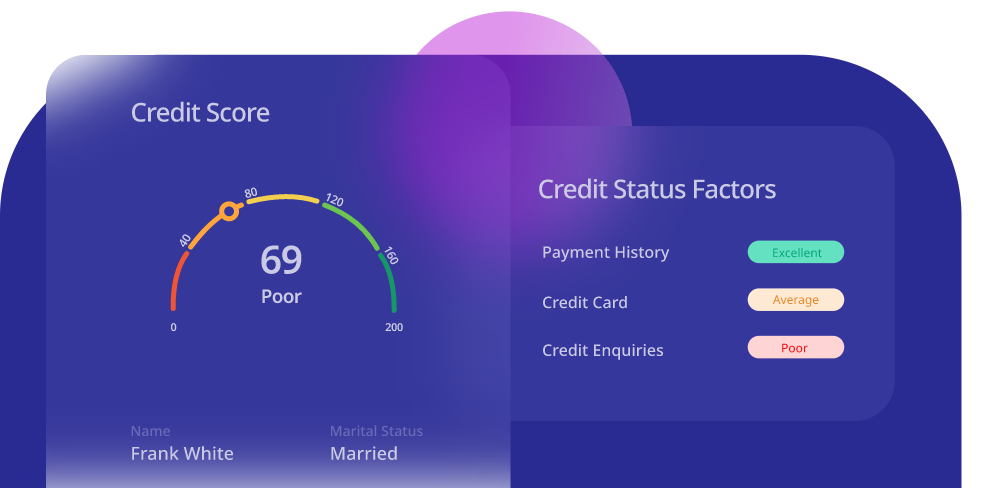

Credit risk scoring is a credit decision engine that helps banks, and financial institutions improve credit quality and acceptance rates through big data. Our virtual scoring and rating system is a reliable solution to keep manual work at a minimum and give your customers fast services.

Choose between build-in or custom virtual scoring and rating solutions by SEPA Cyber.

With SEPA Cyber’s virtual scoring and rating system you get

- Back office to manage credit quality and fight fraud

- Fully automated scoring engine

- Credit decisions in real time

- Removes the risk of human error or personal judgement

Your best solution if you need

Scalability

Adding additional services is now easier with MuSe

Automation

Keep manual work at a minimum

Full compliance

Our built-in features and flexible solutions will meet your country's restrictions

Back office interface

Seamless back office to manage credit quality and fight fraud

A powerful tool for your business

Reliable solution using big data

More than scoring and rating system

- Worldwide availability

- Trustful partner

- Easy integration

Step by step to

complete solution

Fill out our form, and one of our experts will contact you

You will get a demo of our branded core banking system.

Modularity means customer offer for each client

SEPA Cyber Tech is happy to be part of your payment journey

Book your FREE meeting if you want a powerful scoring and rating system. Get your 30 minutes now.